This post is part of the 📖 The Psychology of Money series.

Today, I am reading first chapter No One’s Crazy of the brand new book The Psychology of Money: Timeless lessons on wealth, greed, and happiness written by Author, Morgan Housel.

Doing well with money isn’t necessarily about what you know. It’s about how you behave. And behavior is hard to teach, even to really smart people.

In The Psychology of Money, award-winning author Morgan Housel shares 19 short stories exploring the strange ways people think about money and teaches you how to make better sense of one of life’s most important topics.

Yesterday, I started reading a new book The Psychology of Money and finished the introduction chapter The Greatest Show On Earth.

No One’s Crazy

People from different generations, raised by different parents who earned different incomes and held different values, in different parts of the world, born into different economies, experiencing different job markets with different incentives and different degrees of luck, learn very different lessons.

The challenge for us is that no amount of studying or open-mindedness can genuinely recreate the power of fear and uncertainty.

The economists found that people’s lifetime investment decisions are heavily anchored to their experiences in their own generation—especially experiences early in their adult life.

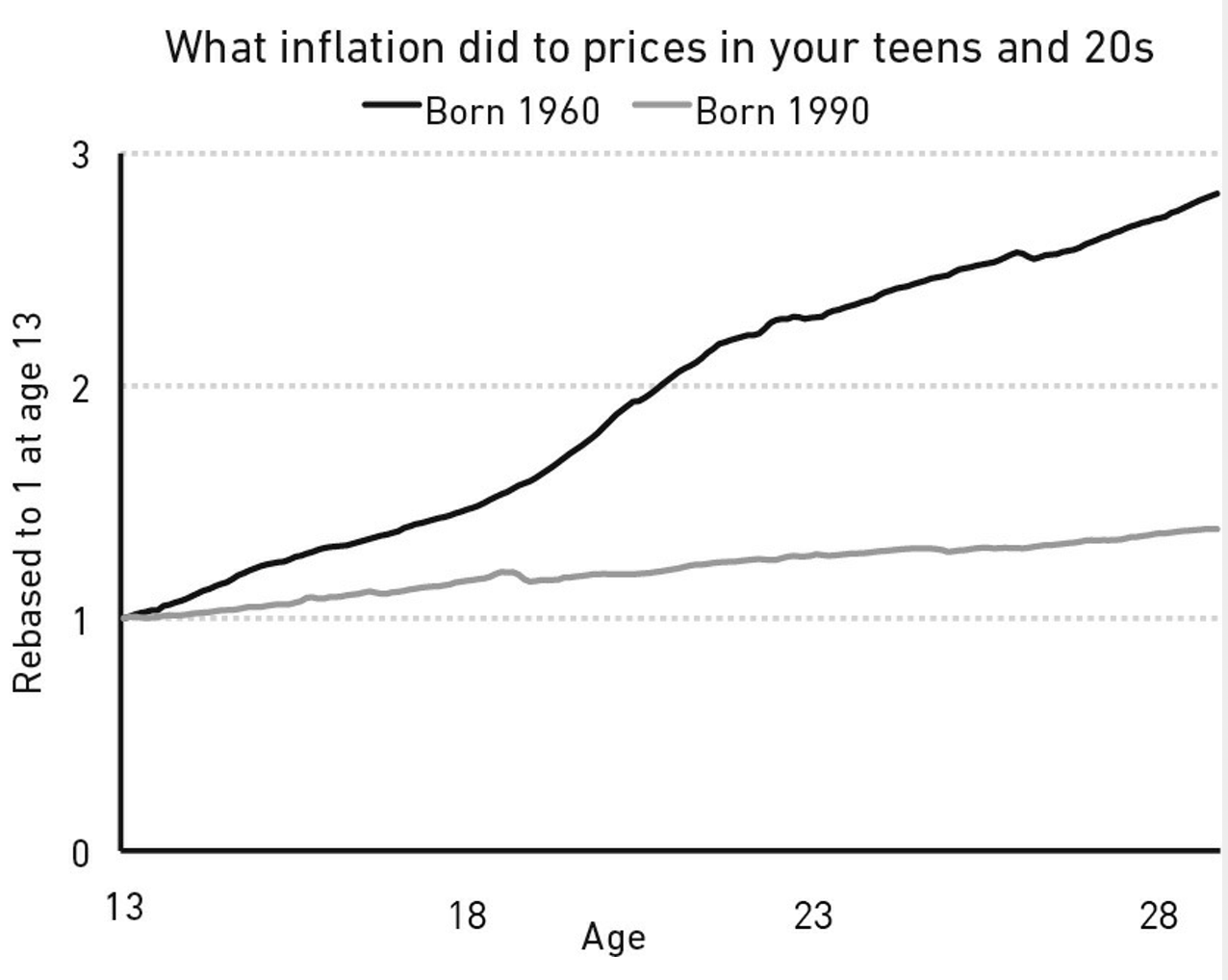

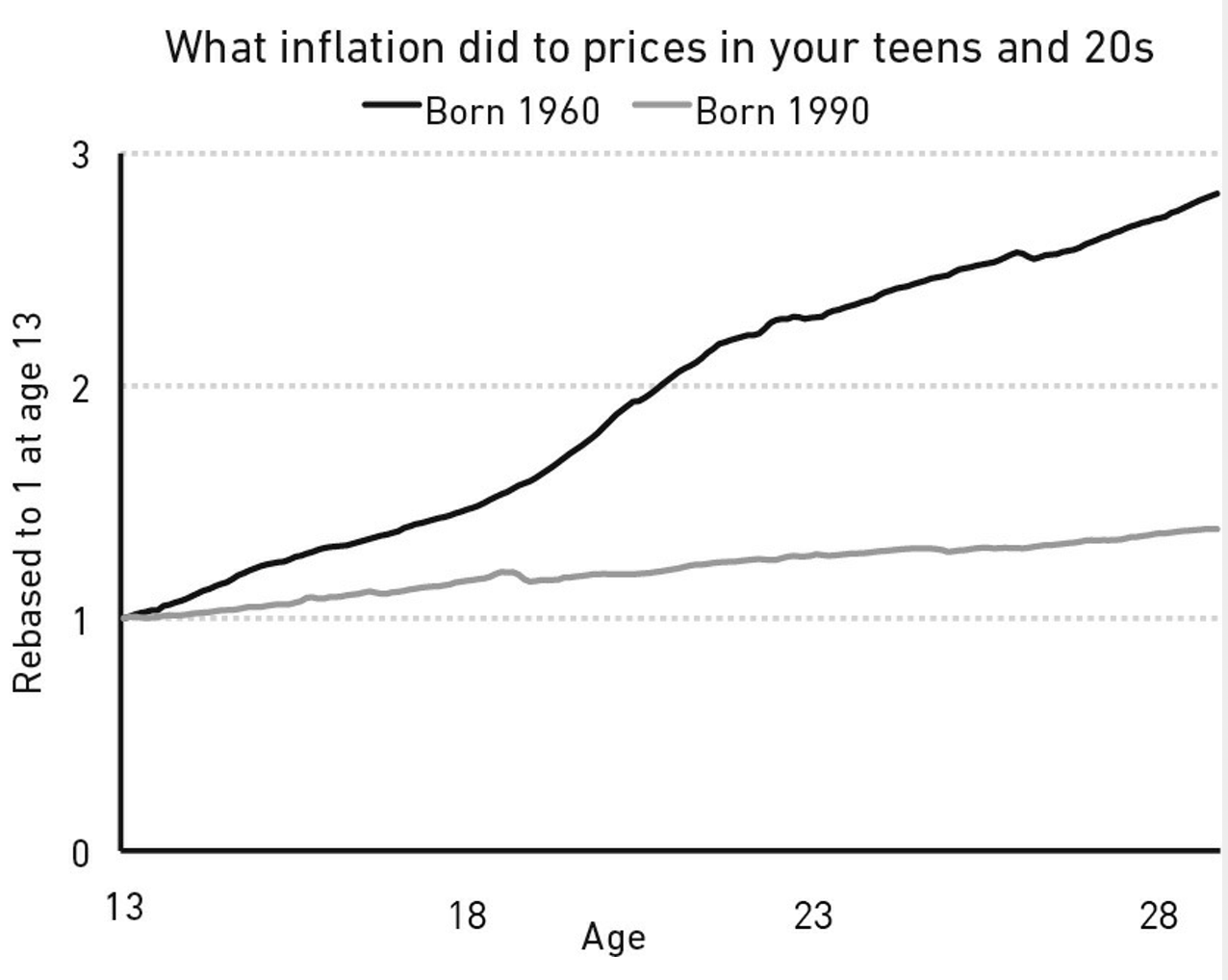

If you grew up when inflation was high, you invested less of your money in bonds later in life compared to those who grew up when inflation was low.

If you happened to grow up when the stock market was strong, you invested more of your money in stocks later in life compared to those who grew up when stocks were weak.

Individual investors’ willingness to bear risk depends on personal history.

Take stocks. If you were born in 1970, the S&P 500 increased almost 10-fold, adjusted for inflation, during your teens and 20s. That’s an amazing return. If you were born in 1950, the market went nowhere in your teens and 20s adjusted for inflation.

Two groups of people, separated by chance of their birth year, go through life with a completely different view on how the stock market works.

Take stocks.

If you were born in 1970, the S&P 500 increased almost 10-fold, adjusted for inflation, during your teens and 20s. That’s an amazing return. If you were born in 1950, the market went nowhere in your teens and 20s adjusted for inflation.

Or inflation.

If you were born in 1960s America, inflation during your teens and 20s—your young, impressionable years when you’re developing a base of knowledge about how the economy works—sent prices up more than threefold. That’s a lot.

You remember gas lines and getting paychecks that stretched noticeably less far than the ones before them. But if you were born in 1990, inflation has been so low for your whole life that it’s probably never crossed your mind.

Key Takeaways

- No one is crazy when it comes to money decisions. We all make decisions based on our own unique experiences that seem to make sense to us in a given moment.

Summary

Every decision people make with money is justified by taking the information they have at the moment and plugging it into their unique mental model of how the world works.

The economists found that people’s lifetime investment decisions are heavily anchored to the experiences those investors had in their own generation—especially experiences early in their adult life.

That’s it for today. Tomorrow, we will read a new chapter Luck & Risk, a story about how Bill Gates got rich.

No One’s Crazy

Every decision people make with money is justified by taking the information they have at the moment and plugging it into their unique mental model of how the world works.

Author(s): Morgan Housel

Part 2 of 23 in the 📖 The Psychology of Money book series.

The Psychology of Money: Timeless lessons on wealth, greed, and happiness - Day 1 | The Psychology of Money: Timeless lessons on wealth, greed, and happiness - Day 3