This post is part of the 📖 The Psychology of Money series.

Today, I am reading Tails, You Win chapter from the book The Psychology of Money: Timeless lessons on wealth, greed, and happiness written by Author, Morgan Housel.

Doing well with money isn’t necessarily about what you know. It’s about how you behave. And behavior is hard to teach, even to really smart people.

In The Psychology of Money, award-winning author Morgan Housel shares 19 short stories exploring the strange ways people think about money and teaches you how to make better sense of one of life’s most important topics.

Yesterday, I finished reading the fifth short story Getting Wealthy vs Staying Wealthy from the book The Psychology of Money.

Tails, You Win

You can be wrong half the time and still make a fortune

Longtails—the farthest ends of the distribution of outcomes—have tremendous influence in finance, where a small number of events can account for the majority of outcomes.

That can be hard to deal with, even if you understand the math. It is not intuitive that an investor can be wrong half the time and still make a fortune.

It means we underestimate how normal it is for many things to fail, which causes us to overreact when they do.

Anything huge, profitable, famous, or influential is the result of a tail event — an outlying one.

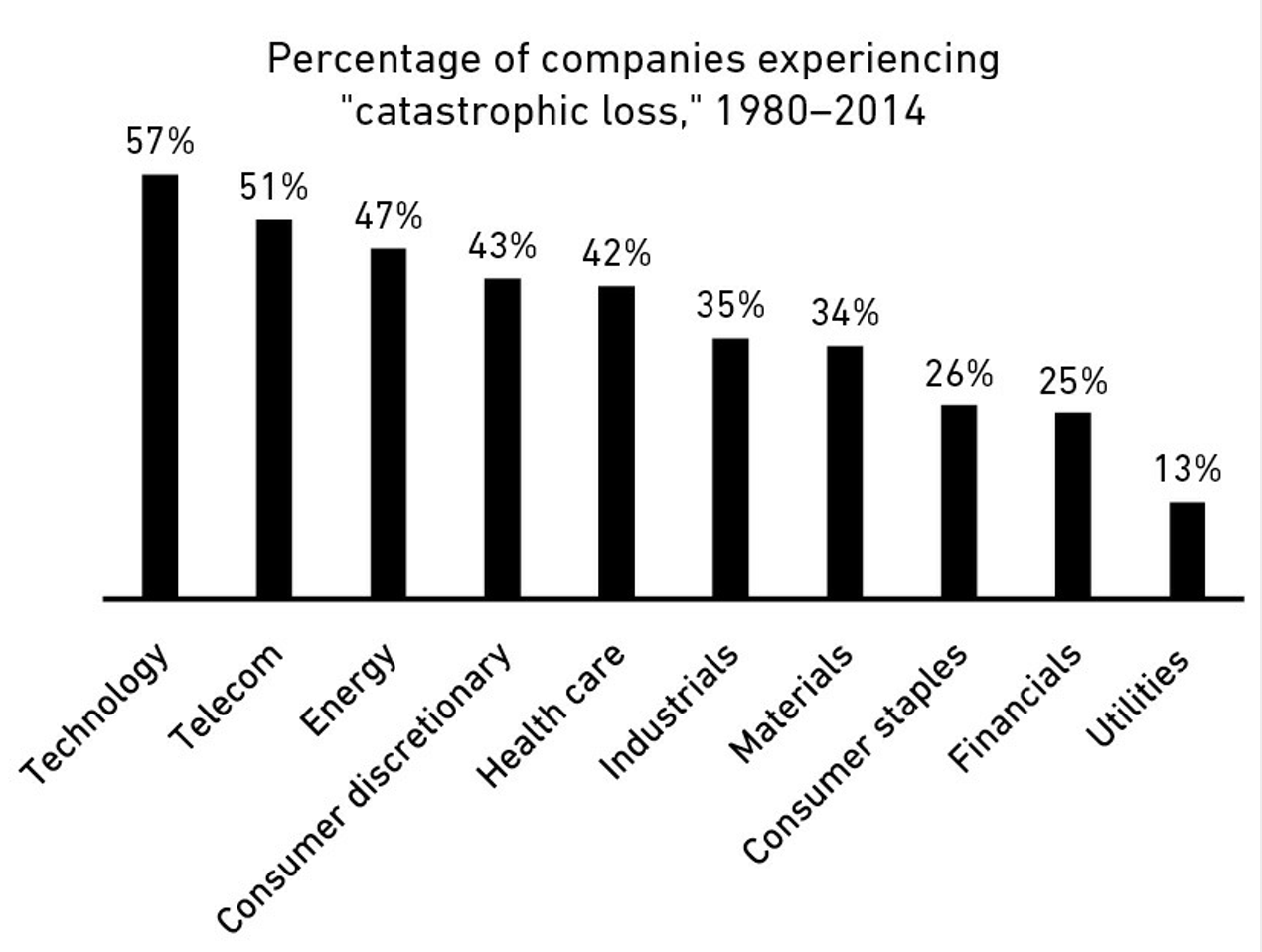

Remember, tails drive everything. The distribution of success among large public stocks over time is not much different from venture capital.

Most public companies are duds, a few do well, and a handful becomes extraordinary winners that account for the majority of the stock market’s returns.

Napoleon’s definition of a military genius was, “The man who can do the average thing when all those around him are going crazy.” It’s the same in investing.

Most financial advice is about today. What should you do right now, and what stocks look like good buys today? But most of the time, today is not that important.

Throughout your life as an investor, the decisions that you make today or tomorrow or next week will not matter nearly as much as what you do during the small number of days—likely 1% of the time or less—when everyone else around you is going crazy.

Summary

- Usually, gains come from a small per cent of your actions called “Long Tail Events”. You can be wrong half the time and still make a fortune. Remember, tails drive everything. Just do the average thing when all those around you are going crazy.

That’s it for today. Tomorrow, we will read the next chapter Freedom, contolling your time is the highest dividend money pays.

No One’s Crazy

Every decision people make with money is justified by taking the information they have at the moment and plugging it into their unique mental model of how the world works.

Luck & Risk

Nothing is as good or as bad as it seems. More important is that as much as we recognize the role of luck in success, the role of risk means we should forgive ourselves and leave room for understanding when judging failures.

Never Enough

There are many things never worth risking, no matter the potential gain. Knowing when you have “enough” is an invaluable skill. Building a sense for “enough” is remarkably simple: Stop taking risks that might harm your reputation, family, freedom and independence.

Don’t forget that being loved by those “whom you want to love” is invaluable than risking everything for money.

Confounding Compounding

Good investing isn’t necessarily about earning the highest returns. It’s about earning pretty good returns that you can stick with and which can be repeated for the longest period of time.

Getting Wealthy vs Staying Wealthy

Good investing is not necessarily about making good decisions. It’s about consistently not screwing up. There are a million ways to get wealthy and plenty of books on how to do so. But there’s only one way to stay wealthy: some combination of frugality and paranoia.

Getting money is one thing. Keeping it is another. If you have to summarize money success in a single word, it would be “survival”.

Tails, You Win

Gains come from a small per cent of your actions called “Long Tail Events”. You can be wrong half the time and still make a fortune. Remember, tails drive everything. Just do the average thing when all those around you are going crazy.

Buy or not to buy

If you want to be wealthy and then stay at the totem pole forever, you must immediately read this book. I bought several copies of this book to gift friends and family. It’s an easy read with a lot of anecdotes and real-life lessons. I already implemented several hacks in my life whistle taking investment decisions.

Author(s): Morgan Housel

Part 8 of 23 in the 📖 The Psychology of Money book series.

Series Start | The Psychology of Money: Timeless lessons on wealth, greed, and happiness - Day 7 | The Psychology of Money: Timeless lessons on wealth, greed, and happiness - Day 9